The European Union is feeling the heat now.. and is considering a one-time write down of Greek bonds on the order of 50%.

ECB to consider a 50% write-down of Greek debt

Translation: "we can't let the speculators who made the bad bets eat their own cookin."

This is another blatant example of how the big banks and their financier speculator brethren will get bailed out by central banks and governments when they put all their chips on red and should have chosen black (leveraged 20:1, of course).

But the average person won't get the same breaks.

Consider, who out there gets an offer from their bank to forgive 50% of their mortgage if they become unemployed? Who out there gets offers from their credit card companies to have their debt slashed if they overreach and can't make the minimum payments anymore? And furthermore who want to keep spending on those cards?

This is the irony of central-bank bailouts; they represent a clear class delineation between who gets 'reset' button privilege and who has to remain in indentured debt servitude.

The net impact of these bailouts is inevitable currency debasement, which leads to higher inflation and subsequent cost of living impacts on those whose payscales take much longer to adjust. This is how the bad bets of a select few are paid back by people who had nothing to do with making them in the first place.

The folks at Fox News would have us all believing the current protests spreading through America are just a rabble. While they were curiously calling Tea Party rioters who literally spit on members of Congress 'patriots' during the health care debate, they have turned tail and disregarded the anguish millions of people are having by derisively calling them 'mobs'.

While there are many opinions expressed at these protests (as there were diverse opinions shouted by Tea Party mobs) the theme of unfair bailouts and related economic stagnation is constant. Most of the Tea Party candidates are silent on the theme of bank bailouts, rather, they call for yet more tax breaks that would benefit the same financier/speculator class!

Look, call me old fashioned, but if you are driving reckless and crash the car, I don't think it's the responsibility of your neighbors to pick up the tab and buy you another. There ought to be a safety valve in free markets that says something like... you make a bad bet, you go bankrupt and let your investors eat the losses. Without such cross-checks the notion of discipline falls by the wayside and ... with the knowledge that the Federal Reserve, the ECB, or their governments will come riding to the rescue if you are foolish... the risks compound and get bigger and bigger with each cycle.

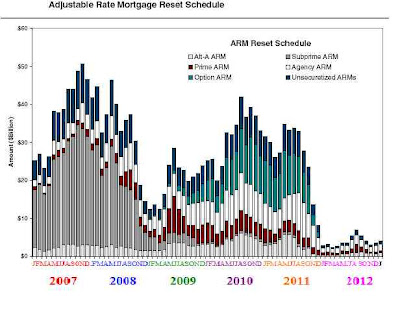

We should have been on the cusp of emerging from this crisis by now. The original trigger (subprime US housing debt) was supposed to be ending about now:

This chart shows the mortgage reset waves. The first hump was subprime debt, and all the damage of 2008 was wrought by that first wave. Then there was a breathing spell during 2008 that should have been used to clean the books, settle the bad debts and let free markets work.

If we had allowed free markets to reallocate the capital from busted bets into areas that had greater discipline, we would likely be in a state of accelerating growth now, with those titans who drove us into the ditch relegated to to the dustbins of outrageous irrelevance, such as Enron, LTCM, and so on. Instead, the bailouts continue which prolong and compound the moral hazard of wave #1 into wave #2, which is one reason our housing markets and economy remain crimped today and for the foreseeable future.

These twerps who wrecked the car in 2007-8 are still running the same institutions and pulling down multi-million dollar compensation packages, this time operating with the full knowledge that they will be made whole if they bet right, if they bet wrong, or if they bet sideways. Our governments won't let them lose.

Whatever happens to the Occupy movement in the near term, people are not going to forget this anytime soon. The awareness generated by these assemblies will hopefully have an impact on the next election cycle in a positive way.

I hope DC is not as deaf, dumb and blind as they appear. They don't need to wait until November 2012 to act.

ECB to consider a 50% write-down of Greek debt

Translation: "we can't let the speculators who made the bad bets eat their own cookin."

This is another blatant example of how the big banks and their financier speculator brethren will get bailed out by central banks and governments when they put all their chips on red and should have chosen black (leveraged 20:1, of course).

But the average person won't get the same breaks.

Consider, who out there gets an offer from their bank to forgive 50% of their mortgage if they become unemployed? Who out there gets offers from their credit card companies to have their debt slashed if they overreach and can't make the minimum payments anymore? And furthermore who want to keep spending on those cards?

This is the irony of central-bank bailouts; they represent a clear class delineation between who gets 'reset' button privilege and who has to remain in indentured debt servitude.

The net impact of these bailouts is inevitable currency debasement, which leads to higher inflation and subsequent cost of living impacts on those whose payscales take much longer to adjust. This is how the bad bets of a select few are paid back by people who had nothing to do with making them in the first place.

The folks at Fox News would have us all believing the current protests spreading through America are just a rabble. While they were curiously calling Tea Party rioters who literally spit on members of Congress 'patriots' during the health care debate, they have turned tail and disregarded the anguish millions of people are having by derisively calling them 'mobs'.

While there are many opinions expressed at these protests (as there were diverse opinions shouted by Tea Party mobs) the theme of unfair bailouts and related economic stagnation is constant. Most of the Tea Party candidates are silent on the theme of bank bailouts, rather, they call for yet more tax breaks that would benefit the same financier/speculator class!

Look, call me old fashioned, but if you are driving reckless and crash the car, I don't think it's the responsibility of your neighbors to pick up the tab and buy you another. There ought to be a safety valve in free markets that says something like... you make a bad bet, you go bankrupt and let your investors eat the losses. Without such cross-checks the notion of discipline falls by the wayside and ... with the knowledge that the Federal Reserve, the ECB, or their governments will come riding to the rescue if you are foolish... the risks compound and get bigger and bigger with each cycle.

We should have been on the cusp of emerging from this crisis by now. The original trigger (subprime US housing debt) was supposed to be ending about now:

This chart shows the mortgage reset waves. The first hump was subprime debt, and all the damage of 2008 was wrought by that first wave. Then there was a breathing spell during 2008 that should have been used to clean the books, settle the bad debts and let free markets work.

If we had allowed free markets to reallocate the capital from busted bets into areas that had greater discipline, we would likely be in a state of accelerating growth now, with those titans who drove us into the ditch relegated to to the dustbins of outrageous irrelevance, such as Enron, LTCM, and so on. Instead, the bailouts continue which prolong and compound the moral hazard of wave #1 into wave #2, which is one reason our housing markets and economy remain crimped today and for the foreseeable future.

These twerps who wrecked the car in 2007-8 are still running the same institutions and pulling down multi-million dollar compensation packages, this time operating with the full knowledge that they will be made whole if they bet right, if they bet wrong, or if they bet sideways. Our governments won't let them lose.

Whatever happens to the Occupy movement in the near term, people are not going to forget this anytime soon. The awareness generated by these assemblies will hopefully have an impact on the next election cycle in a positive way.

I hope DC is not as deaf, dumb and blind as they appear. They don't need to wait until November 2012 to act.

No comments:

Post a Comment